About 2 years ago I paid off my house. My wife and I felt this was the right choice for us, but many in the financial world would actually advise against our decision. As part of this post I’d like to discuss the rationale from both sides of the argument and end on our own conclusions for paying off our mortgage early. First let’s provide a few assumptions as the basis for this discussion as part of the next two sections.

The Market Always Goes Up

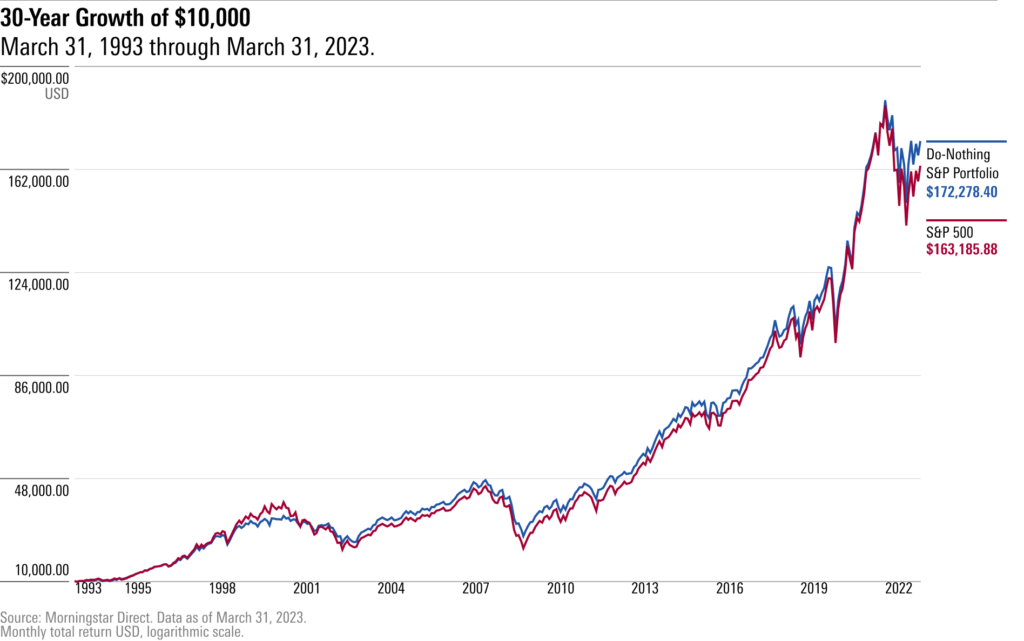

The stock market always goes up. This is not strictly true in the sense that there are fluctuations. Sometimes daily fluctuations, sometimes much larger scales like yearly. Given enough time though, the market will recover and go up. In fact, the market is commonly assumed to increase by about 10% annually on average (sometimes you’ll see a 7% number which is the 10% adjusted for an assumed 3% inflation rate).

Here is a long term graph of the S&P 500 illustrating this point.

Good Debt versus Bad Debt

Many financial experts and advisers often have a two or three process to attaining personal wealth. While everyone is different, the steps are all roughly the same and go as follows:

- Get out of Debt (Debt is an Emergency!!!)

- Create an Emergency Fund (optional)

- Invest in the Stock Market (usually broad based index funds)

This section is about good and bad debt, so I will discuss the first topic in depth after quickly covering the the 2nd and 3rd.

Emergency Fund is a tool primarily used as preventative measure to staying out of debt. Generally, the emergency fund is 25% – 100% annual expenses. If a large expense comes up, this fund can be used so a loan is not necessary to cover the sudden spike money withdrawn from your normal accounts. Whether or not to have an emergency fund is mostly a personal risk question and should be it’s own topic on this blog. An alternative is to invest that money because the yield in the market is often better than any “quick access” money. When an unexpected expense arises simply use a Credit Card and sell stock to cover the bill which will occur roughly one month later.

Invest in broad based mutual funds. This is common advice for most financial independence circles driven from people like JL Collins and Mr. Money Mustache. It is very often not the advice of “finance professionals” which also deserves it’s own blog post. However, it is both an easy and effective way to invest, which is why most of the FIRE community recommend it.

Good Debt versus Bad Debt. Now let’s get down to the good stuff. We did it! 3 for 3 … this topic will also deserve it’s very own blog post. I will cover it a bit further here though, because it directly affected my decision to pay off my house 23 years early. Bad Debt is easy to understand an almost everyone will agree on it too. Credit Cards, Car Loans, Payday Loans, are all forms of Bad Debt. The minimum payments on these make the debt difficult to pay off and generally speaking will cost much more than the purchase prices for the items. Cars depreciate the second they are taken off the lot, there isn’t even equity to reverse the decision shortly after buying. Credit cards have very high interest rates. If amortized on an annual basis payday loans are basically criminal in the percentage of effective interest charged. So these are all BAD.

Good debt is often mentioned as two things: mortgage payments and student loans. In the case of a mortgage the interest has tax benefits and the house is an investment. Student loans are sometimes unavoidable and can potentially provide the means to a more lucrative career and will pay off. So, there are some positives with these types of debt and are thus classified as “good”. In another blog post I will cover these points in more detail and discuss my opinion on the topic.

Investing versus Good Debt Payoff

Finally, we made it! Here are both sides of the argument.

The Stock Market Yield exceeds Mortgage APY

This one is pretty simple to understand. As stated earlier, the average growth of the stock market is something like 7-10% if you allow for a long period of time such as 30 years. This is conveniently also a typical length of a mortgage. Mortgage rates vary year to year, but let’s assume a typical mortgage is 4%. These are both pretty worse case numbers for this argument, but even so will still illustrate a point.

So using an example of $10,000 surplus. If used to invest at 7% for 30 years, that money would be a little over $81,000. If instead that money was put towards the mortgage, it would be worth a little over $33,000 in 30 years! That is nearly a $50,000 dollar difference and almost a 2.5 times higher value on the money. Compounding interest is very powerful and that is what makes this all possible.

Of course this is an extreme example and the closer to end of the mortgage payment the less time for compounding interest to benefit. Even so, if the average yield is greater than the mortgage APY then the money should earn more in the stock market than paying down a mortgage when considering long term of 10-30 years.

Aggressive Payments make Debt Short Term

In the previous section we covered the power of compounding interest. It is a very powerful tool in obtaining personal wealth and will be a topic that comes up often in this blog. While I agree that over a very long term the theoretical amount of money is higher for investing instead of paying down the mortgage, this comes at the expense of short term costs and risks.

First, the house isn’t really yours until the house is paid off. The actually owner of the house is the bank for which you got the loan until that loan is fulfilled. This generally doesn’t materially matter and there is a grey area here. But as may people found out in 2007/8, what they thought they owned was different from what they did.

Second, being really aggressive about paying off the mortgage can make it go really fast. In our case it was 7 years to pay off the loan but we only got super aggressive for 4 of it. Those yields in the stock market are in no way guaranteed to happen in such a short window. In fact, more often that not trying to time the market will result in capital loss. Therefore, it is very hard to equate the difference between a 4% locked return from paying down debt versus the assumed 7-10% yield of the stock market.

Why we Paid Off the House Early

I bought my first house in 2008 during the housing bubble burst. I was a new engineer at the time and had lots of cash on hand. A new housing developer went out of business trying to build the house community where I eventually bought my house. In fact, I was able to effectively negotiate my house for nearly cost just so the developer could stay afloat during this housing crisis. They ultimately didn’t. I freely acknowledge I was lucky to be in the position to buy my first house at the bottom of the market. This story is important to bring up because for me personally, the 2008 housing crisis was eye opening. The banking system failed Americans in a very big way. They lied and cheated and created over leveraged investment products that ultimately came tumbling down like a house of cards. Many people who were making payments still lost their house because the corresponding mortgage company that owned their loan went under. It made me realize that despite saying you own your house, you in fact do not until the mortgage is payed off.

Aggressively paying off the mortgage offers piece of mind. It also offers something else though. A lower cost of living. I have since sold my first house and bought my second one in 2016. In, 2023 I paid it off. Now my “rent” is something like $700 for property taxes. So when looking to get financially independent, not having such a high withdrawal rate to cover a mortgage is very helpful.

Let’s end on how I did this and my thought process. I believe in the stock market. So, before paying down the mortgage I fully invested in my 401k until I reached the annual maximum. Then, I took the surplus that could also be invested in the stock market and paid down the mortgage. That was it. I was effectively trying to get the best of both worlds, and once the house was paid off I was able to invest even more money each month. Overall, this worked for me and my family but this decision is a personal one and has many factors. So please use this as information to help you find the right choices for you.